Read the post on The Guardian. Any bets that Ek loots the company into the wall at 150mph and flips the keys to the first person he sees?

Read the post on The Guardian. Any bets that Ek loots the company into the wall at 150mph and flips the keys to the first person he sees?

[From ArtistRightsWatch: Editor Charlie sez: There are no words for the arrogance.]

Speaking on the company’s fourth quarter earnings call, Ek said certain mistakes were made after the company heavily invested in high-growth areas like podcasts, telling investors: “I probably got a little carried away and over-invested.”

Ek, who called out a shaky macroeconomic environment, emphasized the company will be tightening investments in 2023 across the board as the music streaming giant doubles down on streamlining efficiencies “with greater intensity.”

Read the post on Yahoo! Finance

By Chris Castle

[This post first appeared in MusicTech.Solutions]

Emmanuel Legrand prepared an excellent and important study for the European Grouping of Societies of Authors and Composers (GESAC) that identifies crucial effects of streaming on culture, creatives and especially songwriters. The study highlights the cultural effects of streaming on the European markets, but it would be easy to extend these harms globally as Emmanuel observes.

For example, consider the core pitch of streaming services that started long ago with the commercial Napster 2.0 pitch of “Own Nothing, Have Everything”. This call-to-serfdom slogan may sound good but having infinite shelf space with no cutouts or localized offering creates its own cultural imperative. And that’s even if you accept the premise the algorithmically programed enterprise playlists on streaming services should not be subject to the same cultural protections for performers and songwriters as broadcast radio–its main competitor.

[This] massive availability of content on [streaming] platforms is overshadowed by the fact that these services are under no positive obligations to ensure visibility and discoverability of more diverse repertoires, particularly European works….[plus] the initial individual subscription fee of 9.99 (in Euros, US dollars, or British pound) set in 2006, has never increased, despite the exponential growth in the quality, amount of songs, and user-friendliness of music streaming services.

Artists working new recordings, especially in a language other than English, are forced to fight for “shelf space” and “mindshare”–that is, recognition–against every recording ever released. While this was always true theoretically; you never had that same fight the same way at Tower Records.

This is not theoretically true on streaming platforms–it is actually true because these tens of millions of historical recordings are the competition on streaming services. When you look at the global 100 charts for streaming services, almost all of the titles are in English and are largely Anglo-American releases. Yes, we know–Bad Bunny. But this year’s exception proves the rule.

And then Emmanuel notes that it is the back room algorithms–the terribly modern version of the $50 handshake–that support various payola schemes:

The use of algorithms, as well as bottleneck represented by the most popular playlists, exacerbates this. Furthermore, long-standing flaws in the operations of music streaming platforms, such as “streaming fraud”, “ghost/fake artists”, “payola schemes”, “royalty free content” and other coercive practices [not to mention YouTube withholding access to Content ID] worsen the impact on many professional creators….

This report suggests solutions to bring greater transparency in the use of algorithms and invites stakeholders to undertake a review of the economic models of streaming services and evaluate how they currently affect cultural diversity which should be promoted in its various forms — music genres, languages, origin of performers and songwriters, in particular through policy actions.

Trichordist readers will recall my extensive dives into the hyperefficient market share distribution of streaming royalties known as the “big pool” compared to my “ethical pool” proposal and the “user centric” alternative. As Emmanuel points out, the big pool royalty model belies a cultural imperative–if you are counting streams on a market share basis that results in the rich getting richer based on “stream share” that same stream share almost guarantees that Anglo American repertoire will dominate in every market the big streamers operate.

Emmanuel uses French-Canadian repertoire as an example (a subject I know a fair amount about since I performed and recorded with many vedettes before Quebecoise was cool).

A lot of research has been made in Canada with regards to discoverability, in particular in the context of French-Canadian music, which is subject to quotas for over the air broadcasters which however do not apply to music streaming services. The research shows that while the lists of new releases from Québec studied are present in a large proportion on streaming platforms, they are “not very visible and very little recommended.”

It further shows that the situation is even worse when it is not about new releases, including hit music, when the presence of titles “drops radically.” It is not very difficult to imagine that if we were to swap Québec in the above sentence with the name of any country from the European Union [or any non-Anglo American country], and even with music from the European Union as a whole, we could find similar results.

In other words, there may be aggregators with repertoire in languages other than English that deliver tracks to streamers in their countries, but–absent localized airplay rules–a Spotify user might never know the tracks were there unless the user already knew about the recording, artist or songwriter. (Speaking of Canada, check the MAPL system.)

This is a prime example of why Professor Feijoo and I proposed streaming remuneration in our WIPO study to allow performers to capture the uncompensated capital markets value to the enterprise driven by these performers. Because of the market share royalty system, revenues and royalties do not compensate all performers, particularly regional or non-featured performers (i.e., session players and singers) who essentially get zero compensation for streaming.

Emmanuel also comments on the imbalance in song royalty payments and invites a re-look at how the streaming system biases against songwriters. I would encourage everyone to stop thinking of a pie to be shared or that Johnny has more apples–when the services refuse to raise prices in order to tell a growth story to Wall Street or The City, measuring royalties by a share of some mythical royalty pie is not ever going to get it done. It will just perpetuate a discriminatory system that fails to value the very people on whose backs it was built be they songwriters or session players.

We must think outside the pie.

Judge Trauger rejected Spotify’s theory of privilegium regale that would have protected Daniel Ek from being deposed in the Eight Mile Style case against Spotify and the Harry Fox Agency. His Danielness will now have to submit to deposition testimony under oath in the case that seeks to show Spotify failed to comply with their Title I of the Music Modernization Act as drafted by Spotify’s lobbyists and the regulations overseen by Spotify’s head DC government relations person.

The Judge ruled that Spotify was pushing a theory that the relevant rules applicable to the deposition should be more deferential to high level executives. As a matter of law. That hasn’t been true since Magna Carta. (In 1215 for those reading along at home.)

Oopsie.

Needless to say but I’ll say it, it will be an absolute side splitter if Spotify ends up losing the safe harbor they drafted into US Copyright Law to protect themselves from songwriters seeking justice. And then there’s the HFA issue–you know, the ones that are backend for the MLC that can’t match $500,000,000 of other people’s money.

Stay tuned kids.

Big thanks to Jon at Camden Live for posting about this really important documentary about the deep, down and dirty effects of Spotify on music, musicians and the creative process.

It’s always been a hard road for musicians to make money from their songs. Nonetheless, selling tons of singles and albums was at least a target and something bands could dream about. Of course, there were many ways the labels could work the sales figures to get their shares out first, and only then the bands might see something. Despite the conflict between the often industrial-strength labels and the upcoming artists, there was at least hope that money was flowing back to the content creators. Now though in the age of streaming music, the connection between making music and making a living is profoundly broken.

This schism is the subject matter for Lightbringer Production’s documentary film “The Way The Music Died” featuring insights from musicians and industry pros, including Mishkin Fitzgerald from Birdeatsbaby. The film probes the spirit of artists determined to keep writing songs in the face of the meager payouts from the giant and ever-growing music stream service Spotify. Find out why this is ripping-out the heart and soul of new music.

Getting discovered in the music business has never been easy. Before the pandemic, artists could at least rely on the industry’s historic mainstay to break through — playing as many gigs as possible and hoping to build a following. But with that path closed for now, artists and their label partners are increasingly dependent on Spotify, the undisputed king of music streaming, and its black box algorithms.

That’s why Spotify’s cynical decision to use this moment to launch a new pay-for-play scheme pressuring vulnerable artists and smaller labels to accept lower royalties in exchange for a boost on the company’s algorithms is so exploitative and unfair. Artists must unite to condemn this thinly disguised royalty cut, which apparently has just been released in “beta” mode and is soon expected to enter the market in full force.

As we reported February 9, Spotify is using hundreds of millions of its supernormal stock market riches to acquire naming rights to the Barcelona soccer team. The latest manifestation of Daniel Ek’s monopolist edifice complex was confirmed by Music Business World Wide and Variety among others, as well as Spotify itself. Barcelona’s iconic Camp Nou stadium (largest football stadium in Europe) will now be known as Spotify Camp Nou.

I assume that when Netflix finds out about this, there will be an epilogue to their Edward Bernays-style epic corporate biopic that will ignore the Rogan catastrophe but will include the Barcelona deal with a tight shot on the Spotify Camp Nou and probably a t-shirt vendor.

Let us take one clear message from this navel-gazing naming-rights deal to assuage Daniel Ek’s psyche after a losing bid to acquire the Arsenal football club and join the International League of Oligarchs. That message is that we don’t ever want to hear again about how Spotify “can’t make a profit” or “pays out too much money for music.” Daniel Ek–who controls the company through his super voting stock–has been running that diversion play for way too long and it’s just as much BS spewing from his mouth as it is any of the Silicon Valley oligarchs who whinge about how poor they are when they appear in court.

Let us also agree that anyone who takes a royalty deal from any DSP that does not include an allocation for stock valuation is quite simply a rube who must be laughed at and mocked in the Spotify board room. This stock value allocation doesn’t require a grant of shares, but can include a dollar contribution that tracks share value and should be paid directly to both featured artists, session musicians and vocalists through their collective rights organizations on a nonrecoupment basis.

But don’t let me describe the bullshit, read it yourself directly from Spotify’s “Chief Freemium Business Officer” whatever the hell that means:

“We could not be more thrilled to be partnering with FC Barcelona to bring the worlds of Music and Football together. From July, our collaboration will offer a global stage to Artists, Players and Fans at the newly-branded Spotify Camp Nou. We have always used our marketing investment to amplify Artists and this partnership will take this approach to a new scale. We’re excited to create new opportunities to connect with FC Barcelona’s worldwide fanbase.

Spotify’s mission is to unlock the potential of human creativity, supporting artists to make a living off their art and connecting with fans. We believe this partnership creates many opportunities to deliver on this mission in unique, imaginative, and impactful ways.”

Yes, that’s right. Daniel Ek’s edifice complex is all about unlocking the potential of human creativity because it’s all for the artists, don’t you know.

These people continue to embarrass themselves with their insufferable 1999er BS without realizing that any artist whose name shows up on a single Barcelona jersey will extract a considerable additional payment that the artist will keep and the labels won’t save Spotify on that one. Even if they do, there are only certain artists who don’t mind their names appearing on Barcelona jerseys–for a price. The overwhelming majority will not only not want it but are insulted that the “Chief Freemium Business Officer” is so ignorant of their name and likeness rights that he would even remotely float the idea that Spotify had the right to do anything like that level of grift.

If Mr. Freemium is really serious about “supporting artists to make a living off their art”, forego the edifice stroke and just pay that money directly to featured artists, session folk, and songwriters that have made him rich. Until then, he should just say you’re damn right we used the stockholders money to soothe Daniel Ek’s wounded ego because he desperately wants to be accepted by the Party of Davos and the League of Extraordinary Dweebs. Because we’ve already established what kind of people they are, it’s just a question of negotiating the price.

But let’s face it–what the monopolist really wants is a branded Monopoly game.

This is the third of a three part post on Spotify’s failure to qualify as an “ESG” stock.

[This is an extension of Spotify’s ESG Fail: Environment and Spotify’s ESG Fail: Social. “ESG” is a Wall Street acronym often attributed to Larry Finkat Blackrock that designates a company as suitable for socially conscious investing based on its “Environmental, Social and Governance” business practices. See the Upright Net Impact data model on Spotify’s sustainability score. As of this writing, the last update of Spotify’s Net Impact score was before the Neil Young scandal.]

Spotify has one big governance problem that permeates its governance like a putrid miasma in the abattoir: “Dual-class stock” sometimes referred to as “supervoting” stock. If you’ve never heard the term, buckle up. I wrote an extensive post on this subject for the New York Daily News that you may find interesting.

Dual class stock allows the holders of those shares–invariably the founders of the public company when it was a private company–to control all votes and control all board seats. Frequently this is accomplished by giving the founders a special class of stock that provides 10 votes for every share or something along those lines. The intention is to give the founders dead hand control over their startup in a kind of corporate reproductive right so that no one can interfere with their vision as envoys of innovation sent by the Gods of the Transhuman Singularity. You know, because technology.

Google was one of the first Silicon Valley startups to adopt this capitalization structure and it is consistent with the Silicon Valley venture capital investor belief in infitilism and the Peter Pan syndrome so that the little children may guide us. The problem is that supervoting stock is forever, well after the founders are bald and porky despite their at-home beach volleyball courts and warmed bidets.

Spotify, Facebook and Google each have a problem with “dual class” stock capitalizations. Because regulators allow these companies to operate with this structure favoring insiders, the already concentrated streaming music industry is largely controlled by Daniel Ek, Sergey Brin, Larry Page and Mark Zuckerberg. (While Amazon and Apple lack the dual class stock structure, Jeff Bezos has an outsized influence over both streaming and physical carriers. Apple’s influence is far more muted given their refusal to implement payola-driven algorithmic enterprise playlist placement for selection and rotation of music and their concentration on music playback hardware.)

The voting power of Ek, Brin, Page and Zuckerberg in their respective companies makes shareholder votes candidates for the least suspenseful events in commercial history. However, based on market share, Spotify essentially controls the music streaming business. Let’s consider some of the implications for competition of this disfavored capitalization technique.

Commissioner Robert Jackson, formerly of the U.S. Securities and Exchange Commission, summed up the problem:

“[D]ual class” voting typically involves capitalization structures that contain two or more classes of shares—one of which has significantly more voting power than the other. That’s distinct from the more common single-class structure, which gives shareholders equal equity and voting power. In a dual-class structure, public shareholders receive shares with one vote per share, while insiders receive shares that empower them with multiple votes. And some firms [Snap, Inc. and Google Class B shares] have recently issued shares that give ordinary public investors no vote at all.

For most of the modern history of American equity markets, the New York Stock Exchange did not list companies with dual-class voting. That’s because the Exchange’s commitment to corporate democracy and accountability dates back to before the Great Depression. But in the midst of the takeover battles of the 1980s, corporate insiders “who saw their firms as being vulnerable to takeovers began lobbying [the exchanges] to liberalize their rules on shareholder voting rights.” Facing pressure from corporate management and fellow exchanges, the NYSE reversed course, and today permits firms to go public with structures that were once prohibited.

Spotify is the dominant streaming firm and the voting power of Spotify stockholders is concentrated in two men: Daniel Ek and Martin Lorentzon. Transitively, those two men literally control the music streaming sector through their voting shares, are extending their horizontal reach into the rapidly consolidating podcasting business and aspire soon to enter the audiobooks vertical. Where do they get the money is a question on every artists lips after hearing the Spotify poormouthing and seeing their royalty statements.

The effects of that control may be subtle; for example, Spotify engages in multi-billion dollar stock buybacks and debt offerings, but has yet makes ever more spectacular losses while refusing to exercise pricing power.

So yes, Spotify is starting to look like the kind of Potemkin Village that investment bankers love because they see oodles of the one thing that matters: Fees.

On the political side, let’s see what the company’s campaign contributions tell us:

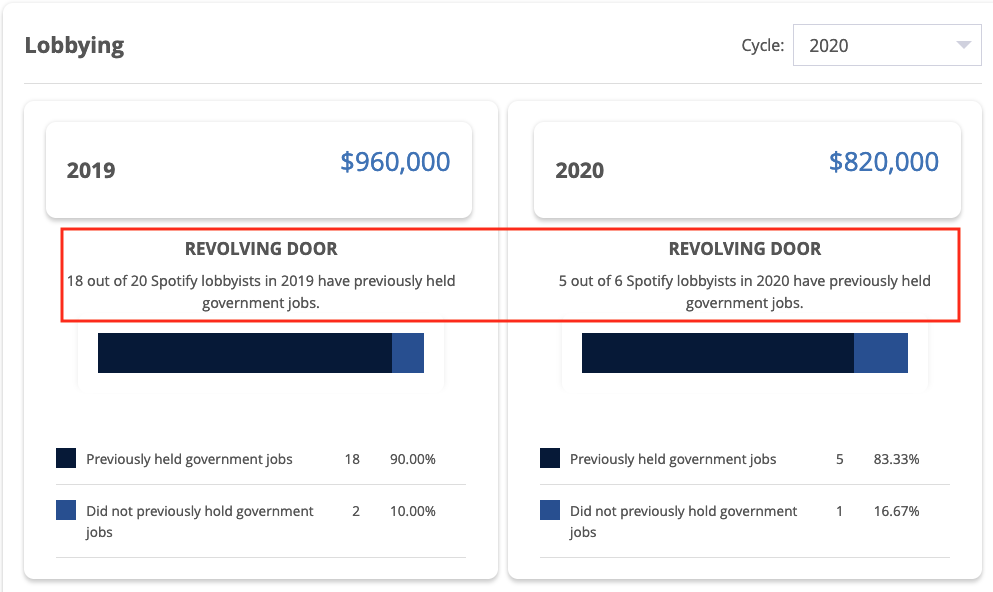

Spotify has also made a habit out of hiring away government regulators like Regan Smith, the former General Counsel and Associate Register of the US Copyright Office who joined Spotify as head of US public policy (a euphemism for bag person) after drafting all of the regulations for the Mechanical Licensing Collective;

Whether this is enough to trip Spotify up on the abuse of political contributions I don’t know, but the revolving door part certainly does call into question Spotify’s ethics.

It does seem that these are the kinds of facts that should be taken into account when determining Spotify’s ESG score. At this point, it looks like Spotify is an ESG fail–which may require divesting by some of the over 600 mutual funds that hold shares.

By Chris Castle

[This post first appeared on MusicTechSolutions.]

[This post is Part 2 of a three part post on Spotify’s ESG Fail, and is an extension of Spotify’s ESG Fail: Environment. “ESG” is a Wall Street acronym often attributed to Larry Fink at Blackrock that designates a company as suitable for socially conscious investing based on its “Environmental, Social and Governance” business practices. See the Upright Net Impact data model on Spotify’s sustainability score. As of this writing, the last update of Spotify’s Net Impact score was before the Neil Young scandal.]

I started to write this post in the pre-Neil Young era and I almost feel like I could stop with the title. But there’s a lot more to it, so let’s look at the many ways Spotify is a fail on the Social part of ESG.

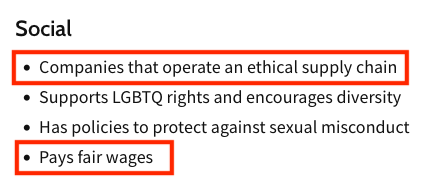

Before Spotify’s Joe Rogan problem, Spotify had both an ethical supply chain problem and a “fair wage” problem on the music side of its business, which for this post we will limit to fair compensation to its ultimate vendors being artists and songwriters. In fact, Spotify is an example to music-tech entrepreneurs of how not to conduct their business.

Treatment of Songwriters

On the songwriter side of the house, let’s not fall into the mudslinging that is going on over the appeal by Spotify (among others) of the Copyright Royalty Board’s ruling in the mechanical royalty rate setting proceeding known as Phonorecords III. Yes, it’s true that streaming screws songwriters even worse that artists, but not only because Spotify exercised its right of appeal of the Phonorecords III case that was pending during the extensive negotiations of Title I of the Music Modernization Act. (Title I is the whole debacle of the Mechanical Licensing Collective scam and the retroactive copyright infringement safe harbor currently being litigated on Constitutional grounds.)

The main reason that Spotify had the right to appeal available to it after passing the MMA was because the negotiators of Title I didn’t get all of the services to give up their appeal right (called a “waiver”) as a condition of getting the substantial giveaways in the MMA. A waiver would have been entirely appropriate given all the goodies that songwriters gave away in the MMA. When did Noah build the Ark? Before the rain. The negotiators might have gotten that message if they had opened the negotiations to a broader group, but they didn’t so now they’ve got the hot potato no matter how much whinging they do.

Having said that, you will notice that Apple took pity on this egregious oversight and did not appeal the Phonorecords III ruling. You don’t always have to take advantage of your vendor’s negotiating failures, particularly when you are printing money and when being generous would help your vendor keep providing songs. And Mom always told me not to mock the afflicted. Plus it’s good business–take Walmart as an example. Walmart drives a hard bargain, but they leave the vendor enough margin to keep making goods, otherwise the vendor will go under soon or run a business solely to service debt only to go under later. And realize that the decision to be generous is pretty much entirely up to Walmart. Spotify could do the same.

Is being cheap unethical? Is leveraging stupidity unethical? Is trying to recover the costs of the MLC by heavily litigating streaming mechanicals unethical (or unexpected)? Maybe. A great man once said failing to be generous is the most expensive mistake you’ll ever make. So yes, I do think it is unethical although that’s a debatable point. Spotify has not made themselves many friends by taking that course. But what is not debatable is Spotify’s unethical treatment of artists.

Treatment of Artists

The entire streaming royalty model confirms what I call “Ek’s Law” which is related to “Moore’s Law”. Instead of chip speed doubling every 18 months in Moore’s Law, royalties are cut in half every 18 months with Ek’s Law. This reduction over time is an inherent part of the algebra of the streaming business model as I’ve discussed in detail in Arithmetic on the Internet as well as the study I co-authored with Dr. Claudio Feijoo for the World Intellectual Property Organization. These writings have caused a good deal of discussion along with the work of Sharky Laguana about the “Big Pool” or what’s come to be called the “market centric” royalty model.

Dissatisfaction with the market centric model has led to a discussion of the “user-centric” model as an alternative so that fans don’t pay for music they don’t listen to. But it’s also possible that there is no solution to the streaming model because everybody whose getting rich (essentially all Spotify employees and owners of big catalogs) has no intention of changing anything voluntarily.

It would be easy to say “fair is where we end up” and write off Ek’s Law as just a function of the free market. But the market centric model was designed to reward a small number of artists and big catalog owners without letting consumers know what was happening to the money they thought they spent to support the music they loved. As Glenn Peoples wrote last year (Fare Play: Could SoundCloud’s User-Centric Streaming Payouts Catch On?,

When Spotify first negotiated its initial licensing deals with labels in the late 2000s, both sides focused more on how much money the service would take in than the best way to divide it. The idea they settled on, which divides artist payouts based on the overall popularity of recordings, regardless of how they map to individuals’ listening habits, was ‘the simplest system to put together at the time,’ recalls Thomas Hesse, a former Sony Music executive who was involved in those conversations.

In other words, the market centric model was designed behind closed doors and then presented to the world’s artists and musicians as a take it or leave it with an overhyped helping of FOMO.

As we wrote in the WIPO study, the market centric model excludes nonfeatured musicians altogether. These studio musicians and vocalists are cut out of the Spotify streaming riches made off their backs except in two countries and then only because their unions fought like dogs to enforce national laws that require streaming platforms to pay nonfeatured performers.

The other Spotify problem is its global dominance and imposition of largely Anglo-American repertoire in other countries. The company does this for one big reason–they tell a growth story to Wall Street to juice their stock price. In fact, Daniel Ek just did this last week on his Groundhog Day earnings call with stock analysts. For example he said:

The number one thing that we’re stretched for at the moment is more inventory. And that’s why you see us introducing things such as fan and other things. And then long-term with a little bit more horizon, it’s obviously international.

Both user-centric and market-centric are focused on allocating a theoretical revenue “pie” which is so tiny for any one artist (or songwriter) who is not in the top 1 or 5 percent this week that it’s obvious the entire model is bankrupt until it includes the value that makes Daniel Ek into a digital munitions investor–the stock.

Debt and Stock Buybacks

Spotify has taken on substantial levels of debt for a company that makes a profit so infrequently you can say Spotify is unprofitable–which it is on a fully diluted basis in any event. According to its most recent balance sheet, Spotify owes approximately $1.3 billion in long term–secured–debt.

You might ask how a company that has never made a profit qualifies to borrow $1.3 billion and you’d have a point there. But understand this: If Spotify should ever go bankrupt, which in their case would probably be a reorganization bankruptcy, those lenders are going to stand in the secured creditors line and they will get paid in full or nearly in full well before Spotify meets any of its obligations to artists, songwriters, labels and music publishers, aka unsecured creditors.

Did Title I of the Music Modernization Act take care of this exposure for songwriters who are forced to license but have virtually no recourse if the licensee fails to pay and goes bankrupt? Apparently not–but then the lobbyists would say if they’d insisted on actual protection and reform there would have been no bill (pka no bonus).

Right. Because “modernization” (whatever that means).

But to our question here–is it ethical for a company that is totally dependent on creator output to be able to take on debt that pushes the royalties owed to those creators to the back of the bankruptcy lines? I think the answer is no.

Spotify has also engaged in a practice that has become increasingly popular in the era of zero interest rates (or lower bound rates anyway) and quantitative easing: stock buy backs.

Stock buy backs were illegal until the Securities and Exchange Commission changed the law in 1982 with the safe harbor Rule 10b-18. (A prime example of unelected bureaucrats creating major changes in the economy, but that’s a story for another day.)

Stock buy backs are when a company uses the shareholders money to buy outstanding shares of their company and reduce the number of shares trading (aka “the float”). Stock buy backs can be accomplished a few ways such as through a tender offer (a public announcement that the company will buy back x shares at $y for z period of time); open market purchases on the exchange; or buying the shares through direct negotiations, usually with holders of larger blocks of stock.

Vox’s Matt Yglesias sums it up nicely:

A stock buyback is basically a secondary offering in reverse — instead of selling new shares of stock to the public to put more cash on the corporate balance sheet, a cash-rich company expends some of its own funds on buying shares of stock from the public.

Why do companies buy back their own stock? To juice their financials by artificially increasing earnings per share.

Spotify has announced two different repurchase programs since going public according to their annual report for 12/31/21:

Share Repurchase Program On August 20, 2021, [Spotify] announced that the board of directors [controlled by Daniel Ek] had approved a program to repurchase up to $1.0 billion of the Company’s ordinary shares. Repurchases of up to 10,000,000 of the Company’s ordinary shares were authorized at the Company’s general meeting of shareholders on April 21, 2021. The repurchase program will expire on April 21, 2026. The timing and actual number of shares repurchased depends on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. The repurchase program is executed consistent with the Company’s capital allocation strategy of prioritizing investment to grow the business over the long term. The repurchase program does not obligate the Company to acquire any particular amount of ordinary shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. The Company uses current cash and cash equivalents and the cash flow it generates from operations to fund the share repurchase program.

The authorization of the previous share repurchase program, announced on November 5, 2018, expired on April 21, 2021. The total aggregate amount of repurchased shares under that program was 4,366,427 for a total of approximately $572 million.

Is it ethical to take a billion dollars and buy back shares to juice the stock price while fighting over royalties every chance they get and crying poor? I think not.

I think there’s clearly a legitimate question of whether Spotify fails on the environmental and social prongs of ESG. In Part 3 we will consider “governance.”

You must be logged in to post a comment.