By Chris Castle

[This MusicTechPolicy post appeared on Hypebot]

There’s an old saying among sailors that water always wins. Sunlight does, too. It may take a while, but time reveals all things in the cold light of dawn. So when you are free riding on huge blocks of aged government cheese like the digital music services do with the compulsory mechanical license, the question you should ask yourself is why hide from the sunlight? It just makes songwriters even more suspicious.

This melodrama just played out at the Copyright Royalty Board with the frozen mechanicals proceeding. Right on cue, the digital services and their legions of lawyers proved they hadn’t learned a damn thing from that exercise. They turned right around and tried to jam a secret deal through the Copyright Royalty Board on the streaming mechanicals piece of Phonorecords IV.

To their great credit, the labels handled frozen physical mechanicals quite differently. They voluntarily disclosed the side deal they made with virtually no redactions and certainly didn’t try to file it “under seal” like the services did. Filing “under seal” hides the major moving parts of a voluntary settlement from the world’s songwriters. Songwriters, of course, are the ones most affected by the settlement–which the services want the CRB to approve–some might say “rubber stamp”–and make law.

To fully appreciate the absolute lunacy of the services attempt at filing the purported settlement document under seal, you have to remember that the Copyright Royalty Judges spilled considerable ink in the frozen mechanicals piece of Phonorecords IV telling those participants how important transparency was when they rejected the initial Subpart B settlement.

This happened mere weeks ago in the SAME PHONORECORDS IV PROCEEDING.

Were the services expecting the Judges to say “Just kidding”? What in the world were they thinking? Realize that filing the settlement–which IF ACCEPTED is then published by the Judges for public comment under the applicable rules established long ago by Congress–is quite different than filing confidential commercial information. You might expect redactions or filings under seal, “attorneys eyes only,” etc., in direct written statements, expert testimony or the other reams of paper all designed to help the Judges guess what rate a willing buyer would pay a willing seller. That rate to be applied to the world under a compulsory license which precludes willing buyers and willing sellers, thank you Franz Kafka.

When you file the settlement, that document is the end product of all those tens of millions of dollars in legal fees that buy houses in the Hamptons and Martha’s Vinyard as well as send children to prep school, college and graduate school. Not the songwriters’ children, mind you, oh no.

The final settlement is, in fact, the one document that should NEVER be redacted or secret. How else will the public–who may not get a vote but does get their say–even know what it is the law is based on assuming the Judges approve the otherwise secret deal. It’s asking the Judges to tell the public, the Copyright Office, their colleagues in the appeals courts and ultimately the Congress, sorry, our version of the law is based on secret information.

Does that even scan? I mean, seriously, what kind of buffoons come up with this stuff? Of course the Judges will question the bona fides and provenance of the settlement. Do you think any other federal agency could get away with actually doing this? The lawlessness of the very idea is breathtaking and demonstrates conclusively in my view that these services like Google are the most dangerous corporations in the world. The one thing that gives solace after this display of arrogance is that some of them may get broken up before they render too many mechanical royalty accounting statements.

To their credit, after receiving the very thin initial filing the Judges instructed the services to do better–to be kind. The Judges issued an order that stated:

The Judges now ORDER the Settling Parties to certify, no later than five days from the date of this order, that the Motion and the Proposed Regulations annexed to the Motion represent the full agreement of the Settling Parties, i.e., that there are no other related agrements and no other clauses. If such other agreements or clauses exist, the Settling Parties shall file them no later than five days from the date of this order.

Just a tip to any younger lawyers reading this post–you really, really, really do not want to be on the receiving end of this kind of order.

Reading between the lines (and not very far) the Judges are telling the parties to come clean. Either “certify” to the Judges “that there are no other related agreements and no other clauses” or produce them. This use of the term “certify” means all the lawyers promise to the Judges as officers of the court that their clients have come clean, or alternatively file the actual documents.

That produced the absurd filing under seal, and that then produced the blowback that led to the filing of the unsealed and unreacted documents. But–wait, there’s more.

Take a close look at what the Judges asked for and what they received. The Judges asked for certification “that there are no other related agrements and no other clauses. If such other agreements or clauses exist, the Settling Parties shall file them no later than five days from the date of this order.”

What the Judges received is described in the purportedly responsive filing by the services:

The Settling Participants [aka the insiders] have provided all of the settlement documentsand, with this public filing, every interested party can fully evaluate and comment upon the settlement. The Settling Participants thus believe that the Judges have everything necessary to “publish the settlement in the Federal Register for notice and comment from those bound by the terms, rates, or other determination set by the” Settlement Agreement, as required under 37 C.F.R. 351.2(b)(2). The Settling Participants respectfully request that the Judges inform them if there is any further information that they require.

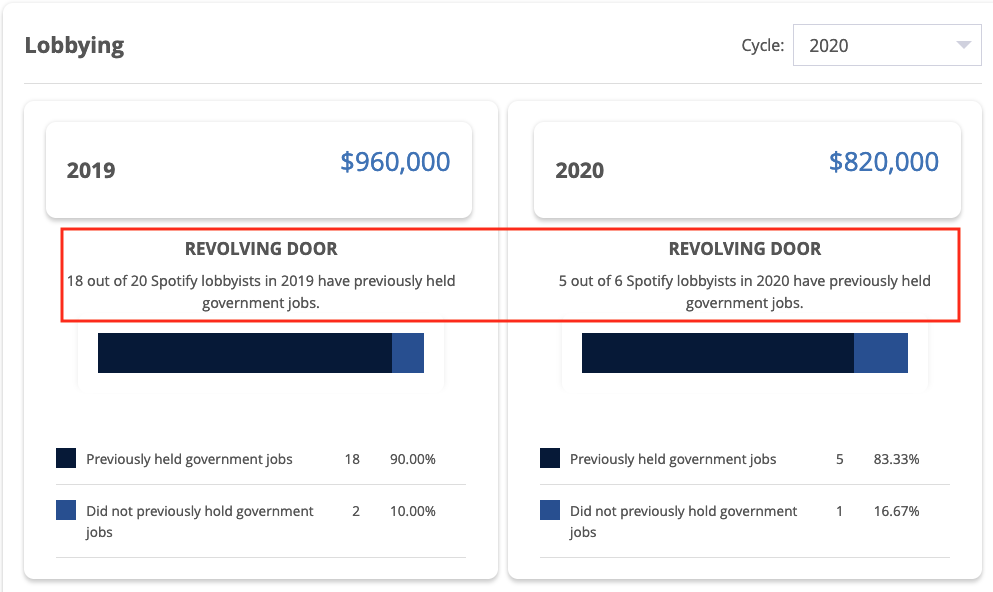

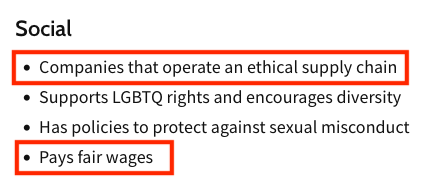

Notice that the Judges asked for evidence of the “full agreement of the Settling Parties”, meaning all side deals or other vigorish exchanged between the parties including the DSPs that control vast riches larger than most countries and are super-conflicted with the publishers due to their joint venture investment in the MLC quango.

The response is limited to “the settlement documents” and then cites to what the services no doubt think they can argue limits their disclosure obligations to what is necessary to “publish the settlement”. And then the services have the brass to add “The Settling Participants respectfully request that the Judges inform them if there is any further information that they require.” Just how are the Judges supposed to know if the services complied with the order? Is this candor?

It must also be noted that Google and the NMPA have “lodged” certain documents relating to YouTube’s direct agreements which they claim are not related to the settlement to be published for public comment. These documents are, of course, secret:

[And] are not part of the settlement agreement or understanding of the settling participants concerning the subject matter of the settlement agreement, and do not supersede any part of the settlement agreement with respect to the settling participants’ proposed Phonorecords IV rates and terms. Further, the letter agreements do not change or modify application of the terms to be codified at 37 C.F.R. 385 Subparts C and D, including as they apply to any participant. Rather, the letter agreements simply concern Google’s current allocation practices to avoid the double payment of royalties arising from YouTube’s having entered into direct agreements with certain music publishers while simultaneously operating under the Section 115 statutory license.

You’ll note that there are a number of declarative statements that lets the hoi polloi know that the Data Lords and Kings of the Internet Realms have determined some information involving their royalties is none of their concern. How do you know that you shouldn’t worry your pretty little head about some things? Because the Data Lords tell you so. And now, back to sleep you Epsilons.

So you see that despite the statements in the group filing to the CRB that the “Settling Participants” (i.e., the insiders) claim to have provided all of the settlement documents required by the Judges, Google turns right around and “lodges” this separate filing of still other documents that they think might be related documents with some bearing on the settlement that should be disclosed to the public but they apparently will not be disclosing without a fight. How do we know this? Because they pretty much say so:

Because the letter agreements are subject to confidentiality restrictions and have each only been disclosed to their individual signatories, each such music publisher having an extant direct license agreement with Google, Google and NMPA are lodging the letter agreements directly with the Copyright Royalty Judges, who may then make a determination as to whether the letter agreements are relevant and what, if anything, should be disclosed notwithstanding the confidentiality restrictions in each of the letter agreements.

Ah yes, the old “nondisclosure” clause. You couldn’t ask for a better example of how NDAs are used to hide information from songwriters about their own money.

The Judges noted when rejecting the similar initial frozen mechanical regulations that:

Parties have an undeniable right of contract. The Judges, however, are not required to adopt the terms of any contract, particularly when the contract at issue relates in part, albeit by reference, to additional unknown terms that indicate additional unrevealed consideration passing between the parties, which consideration might have an impact on effective royalty rates.

So there’s that.

What this all boils down to is that the richest and most dangerous corporations in commercial history are accustomed to algorithmically duping consumers, vendors and even governments in the dark and getting away with it. The question is, if you believe that sunlight always wins, do they still want to hide as long as they can and then look stupid, or do they want to come clean to begin with and be honest brokers.

As Willie Stark famously said in All the King’s Men, “Time reveals all things, I trust it so.”

You must be logged in to post a comment.